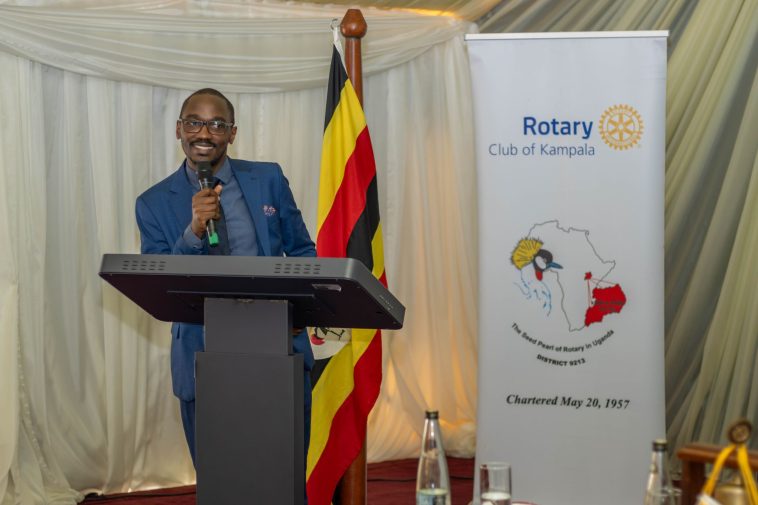

I facilitated a conversation around tax as an enabler or impediment of business courtesy of the Rotary club of Kampala and it’s amazing how widely the perspectives vary depending on the lens with which one views the topic of taxation.

Kicked off with the classic expression “In this world, nothing is certain except death and taxes” as it lays out the reality of life’s inevitabilities.

On the upside, we came to the realisation that:

– Compliance with one’s tax obligations saves them from significant outflows in terms of interest and penalties if the principal sum is remitted on time.

– As financial institutions continue to adopt tax compliance as part of their KYC procedures, it could determine whether one is able to access financing or otherwise.

– Tax Clearance Certificates (TCCs) which are solely issued by the tax authorities are now a critical requirement for government bidding.

On the other hand, there are some bottlenecks that could be associated to taxation including:

– Cashflow constraints arising from having to settle one’s tax obligations before receiving payment from their customer

– Rising use of agency notices by the tax authorities to collect amounts from one’s bank account without their knowledge/consent.

– Hindrance to potential partnerships resulting from accumulated liabilities identified through tax due diligence carried out at the request of the incoming partner.

Takes me back to high school when we debated about such seemingly obvious topics like “water is better than fire” and then realised after both sides had passionately submitted for a while that perhaps both were of equal magnitude.

Utmost gratitude for the invitation which reminded me about how noble a cause it is to be part of Rotary as a fraternity as manifested by the positive views shared about taxation, which is a subject that shapes society.

This post was created with our nice and easy submission form. Create your post!