My mother is a wise woman. In 1994 she made me get a bank account saying I wouldn’t have any pocket money if I had no bank account. I still have that bank account. At 82 this August, my mother still keeps a check book and every now and then, potters to the bank to carry out her business. But then my mother is no ordinary Ugandan and neither am I. At Anathoth Clothing, my clients pay by check, bank transfer or bank card. Every once in a while, we take a mobile money payment. Importantly, we can take mobile money payments online, and that’s no mean feat.

Last week I did my taxes. Because of those mobile money receipts, I needed to reconcile a few things and I went to the MTN Service Center at the Acacia Mall to request an annual statement. The young lady at the counter looked me in the face and said ‘ma’am, I’m afraid I can only provide a statement for the last ninety days. If you want a six months or an annual statement you will have to get a court order and then MTN at Hannington Road will provide the statement. Short of that, you won’t get one, for security reasons.” To say the least, I was taken aback. National ID, registered phone number and all, I have no access to my mobile money statement. That’s glitch number one.

It’s an open secret that MTN and Airtel move more money on any day than most commercial banks in this country. Only about 21% of Ugandans are banked, with about 7.4 million bank accounts. Yet, there are 24.8 million mobile devices in this country with 22 million mobile money subscribers. These carried out transactions worth 54 trillion in 2017, and that’s half our GDP.

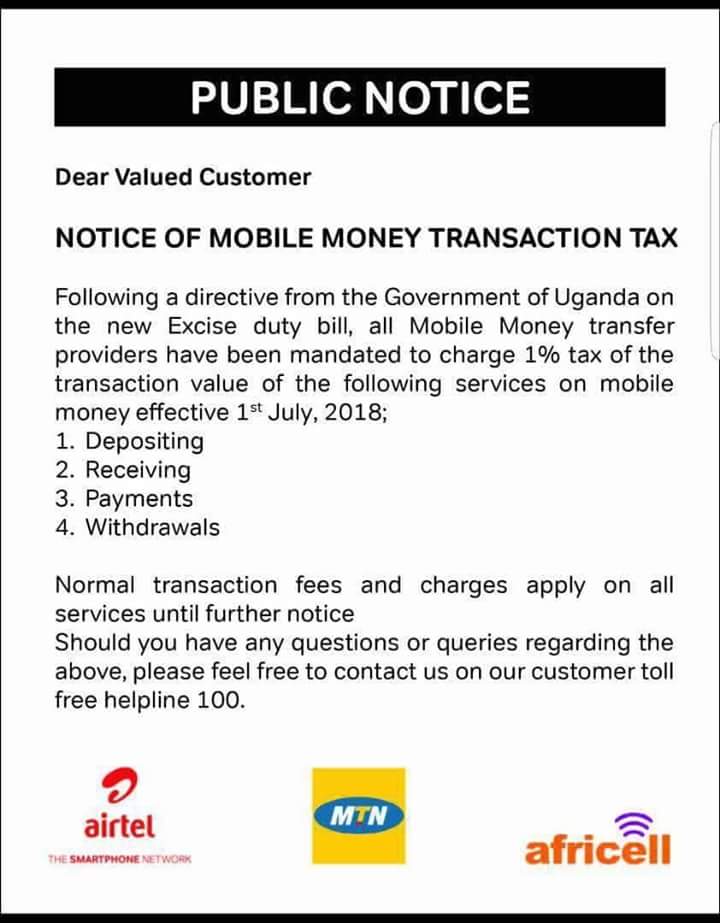

The new tax on mobile money is a bad tax. It is a bad tax because it is a double tax twice over. The average mobile money user is a small business owner or petty trader. Its all very well for us to return to banking, but it should not always be about us, what works for us, what is convenient for us and so forth. There must always be something beyond the me, myself and I attitude, consideration for those that are not like us, and especially for those that are disadvantaged in some way.

For all its harshness, clearly, no one took the time to examine what the effect of a tax structured this way would be. The petty trader’s profit margins are meager. Consider the roadside tomato seller, the vegetable vendor and the matooke trader who must make payment to the farmer out there before their goods can be delivered to Kampala. Those people count their money by the shilling. Then there is the young lady who ekes out a living sitting behind a wooden box at the roadside, ka-tochi phone in hand, receiving and dishing out money for a paltry sum. Nobody thought what will happen to her when her customers dwindle. Nobody seems to care about the effect of policy on people like that.

And the commercial banks especially are about the money. When agency banking started, many that took the licenses did not make use of them. Others still are attempting to exit the service. The agency banking system is structured to exclude, rather than deepen financial services. The client must still have a bank account yet the intricacies of opening a bank account have not changed. The agent banker is expected to provide float, a sum of money against which they can carry out each transaction, taking deposits or making payouts. When the agent starts out, the banks promise that anything from three to five million shillings is sufficient for float. But those who have tried their hand at agency banking insist they need at least ten million shillings to make business sense.

Float, on the face of it, is capital. But the requirement that the banking agent must have the money deposited on their own bank account implies that the agent provides capital to the bank so they can serve the bank’s customers. Indeed the agent lends their money to the bank to serve the bank’s clients. The banking agent cannot take or pay out against checks, the same way they can not carry out electronic funds transfers.

If our ease of doing business indicators show we lag behind the rest of the region, standing at number 122 out of 190 countries, down from 115 in 2016, it’s counter-intuitive to create another bottleneck for small enterprises, while we insist that we are working to help them formalize their processes, and that we should enable the informal sector grow by creating an enabling environment.

Must we then be aiming to stifle and kill one hugely successful, local, financial services product to promote another? We cannot be shouting about financial sector deepening and financial inclusion and at the same time tax, several times over, a hugely successful financial services product that never excluded anybody. The only requirement for anyone to have a mobile money account is a registered phone line and a national ID. Anybody can get those. Moreover, you do not even have to subscribe to the service to access it!

Agency banking is not an alternative to mobile money. It brings with it the same glitches that the regular commercial bank does. Indeed the banks must understand that the way they are structured does not work for everybody. The market is heavily segmented and while we all need access to financial services of some sort, banking for all its intricate and formal nature does not necessarily work for the illiterate peasant woman or man same way it does for me. Yet, its people like that who need alternatives to the formal financial services, enabling inclusion.

We could have been wiser. But shoot ourselves in the foot and shoot ourselves in the foot we have. Indeed this mobile money thing will create a glitch in the entire country’s value system. While this economy needs money to run, it matters how that money is found. But taxing an all-inclusive financial service several times over just doesn’t cut it! Mobile money created a certain formality to financial transactions. Now we are being driven back into informality and to carrying cash, with all its inflationary tendencies.

I don’t have to use mobile money. But how can I live life and work with 24.8 million other people and be the outlier? Economies are living breathing systems and there are certain things that none of us can ever get away from. But Ugandans are a bunch of ingenious people who will avoid that tax and will find other means to pay for things. They have done it before and they certainly will do it again.

This post was created with our nice and easy submission form. Create your post!